The Coronavirus Job Retention Scheme (CJRS) was first announced in March and it has never stopped changing since then. The next few months of furlough have now been mapped out by the government. These are the key issues for employers over the summer:-

- Employers cannot now furlough anyone who has not already been furloughed. Only employees who were furloughed for at least 21 days by the end of June 2020 remain eligible to be furloughed in the remaining months of the scheme.

- Employees returning from statutory parental leave are the only exception to this new restriction. They can be furloughed for the first time after 1 July 2020.

- From 1 July 2020, employers will also be limited to furloughing no more than the highest number of employees who had been furloughed previously at any one time. In other words, if an employer had only ever claimed for 50 furloughed employees at a time, they cannot furlough more than 50 at any one time from July.

- “Flexible furlough” comes in on 1 July 2020. Employers will be able to bring employees back to work on a part-time basis for any amount of time (ie NOT a minimum of 21 days) and on any work pattern, whilst still being able to claim some furlough grant to reflect the periods when the employee is not needed at work. Details of the new flexible scheme are here. A helpful worked example is here.

- Flexible furlough arrangements will have to be agreed with employees and will need to be confirmed in writing. This mirrors what was meant to happen at the start of the CJRS and is vital, both for HMRC audit purposes and so that employers and employees are crystal clear about what work is required and how much is being paid for that work.

- Employers need to be very careful about how and when they claim furlough grant. 31 July is the last day that employers can submit claims for periods ending on or before 30 June. The first time employers will be able to make claims for days in July will be 1 July. The way in which claims can be made via the HMRC portal is also changing from 1 July.

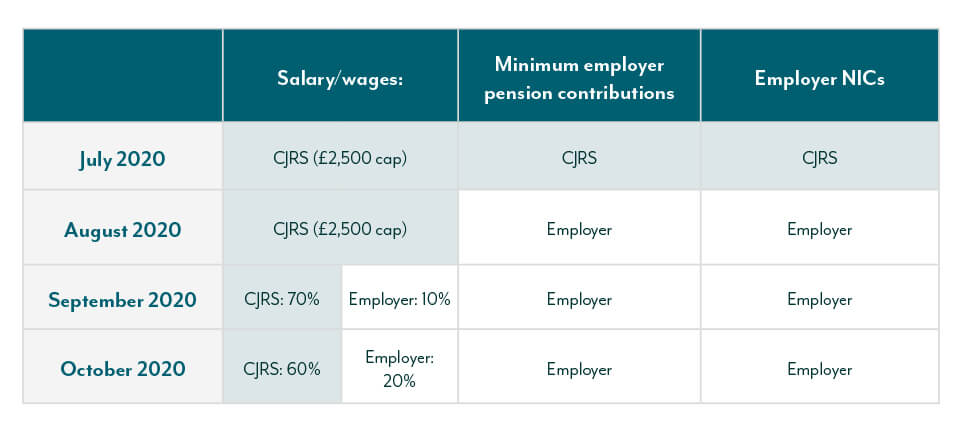

- From 1 August 2020 the CJRS starts to require a bigger contribution from employers. From August, employers will have to pay employer NICs and employer pension contributions. From September, the 80% (or £2,500 per month) upper limit for furlough grant is reduced to 70%, with the employer making up the difference. In October, the government will contribute 60%, with the employer again making up the difference. This is what it looks like:-

- The rules about what an employee can and cannot do when furloughed are exactly the same under flexible furlough. An employee who is furloughed every Friday, for example, cannot provide services for their employer on a Friday (although they can undertake training, as before). HMRC will be looking for employers who are abusing the scheme and making fraudulent claims.

- Although the CJRS was introduced in an effort to stave off redundancies, there is still nothing to stop an employer who has too many employees for the available work making employees redundant. As ever, employers will have to ensure that they go through any collective consultation before they make anyone redundant AND will need to make sure that they have acted fairly when dismissing any employees for this reason.

- The CJRS is still scheduled to come to an end on 31 October 2020.

If you need more guidance on any of the issues referred to above, please contact Michael Stokes at [email protected] or on 07807 747 455.