A study of 1.1m entrepreneurial SMEs in the UK showed that 28% of businesses are using private equity funding.

Having spent years growing a successful business, you may now be considering taking on investment to support its next phase of growth. Or you could be part of a successful management team which is considering taking over the business from its current owners.

Private equity investors actively seek out established businesses looking to develop, identifying potential targets and will often make direct targeted approaches. The process can also work the other way with a business seeking out a potential investment themselves. Whichever situation applies, before any conversations or pitches take place, it’s crucial to make sure that your business is investor ready to secure its real value and ensure the business is attractive to potential investors.

How can I get my business ‘investor ready’?

Firstly, do you understand the private equity (PE) process? PE investments are complex transactions with a large number of moving parts and different interests to align. Investors will be keen to understand, and have confidence in, the management team and wider organisational structure. They may also look to bring in additional resources themselves to support any potential gaps. This type of investment is typically a medium-term scenario with investors looking to sell their stake within three to five years.

Research, research, research. Speaking to other people who have already been through the process themselves, or who are getting ready to, can be invaluable. Find out what went well (or not so well) for them and any lessons they have learned along the way. Get recommendations and start looking at private equity firms with experience in your sector or a track record of investing in similar businesses.

Make sure this is the right route for your business. How much investment do you need and what are you hoping to achieve from it? PE investment can also bring a great deal of added value including sector expertise, a track record in growing businesses and connections in target markets which might otherwise be harder to access.

Finally, don’t underestimate the time it takes to get a business investor ready. Being able to demonstrate elements such as profitability, a good organisational structure and a healthy pipeline, customer base or orderbook will make a business much more attractive to investors.

How can HCR help my business to prepare?

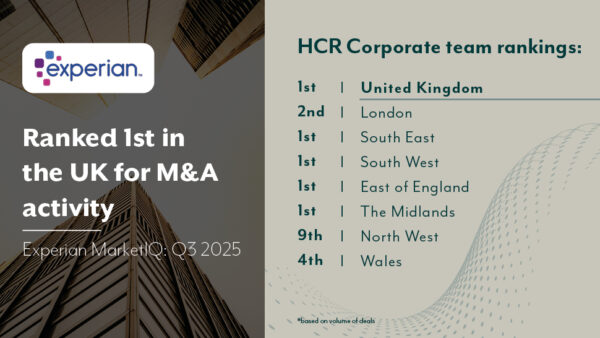

This is our world. Advising businesses on sales, mergers and investments is at the heart of our corporate work and our award-winning team has decades of experience in this area.

It can also be complex, working with multiple advisors to get the deal over the line. We have developed a great network through the years and share our insight and experience to prepare our clients for investment.

Our approach is to provide clear, jargon-free advice, making sure our clients understand the process and are aware of everything they need to consider before pursuing the private equity route.

Rachel Turner and Rob Rice are partners in the Corporate team at HCR and are based in the firm’s Thames Valley office. From sales and acquisitions to strategic investments, they support businesses with a range of corporate matters.

If you’re looking for support to take your business to the next level, you’ll want us on your side.