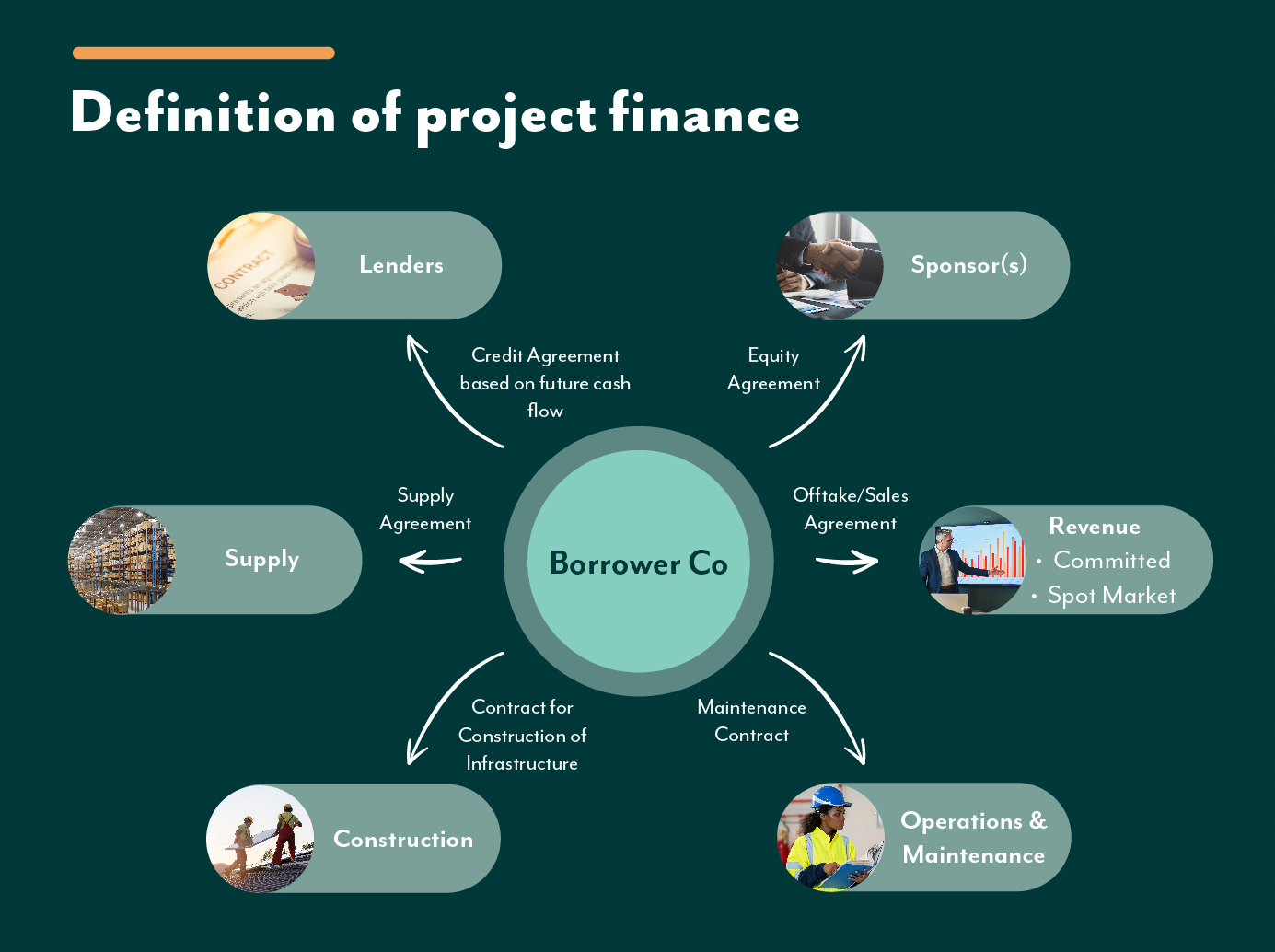

Even though there is no dictionary definition of project financing, we have attempted to describe what it looks like through highlighting some of its key attributes:

Initially, a borrower, sponsor or a developer needs to be in the process of seeking funding for the construction and implementation of a capital-intensive project. A lender, when approached by the sponsor, borrower or developer, will focus principally on the cashflows generated by the operation of the project. They will be seen as the source of funds from which any loans paid out by the lenders will be repaid.

Project finance structure and security

Another key attribute of project finance is that it is structured in a way that the potential loss of the sponsor, borrower or developer will be confined to its equity stake – the amount of ownership – in the project company or special purchase vehicle.

Security – also known as collateral – for any debt raised by the sponsor, borrower or developer will be confined to the assets of the project itself. In particular, security can be confined to equity, revenue streams and sometimes contingent support from sponsors, shareholders and other project stakeholders.

Most project financings come with an integrated security package. This usually consists of project assets or contracts; cashflows, land, equipment etc. Just like a mortgage or buy-to-let investment, no security package is ever the same. It is the subject of the availability of security by the project, sponsors, borrowers and developers and the specific requirements of the lenders on that particular transaction.

When tailoring a security package to a specific transaction, most lenders adapt a risk-weighted approach to the sponsors, borrowers, developers and the overall fundamentals of the project. These factors feed into what is widely described as the lender’s view of the overall ‘bankability’ of the project. The higher the risks allocated to the project by a lender – i.e., the lower the bankability – the higher the inclination for that lender to require a robust a security package as possible.

Repayment

The repayment of the project loan will be funded from the proceeds derived from the project itself. The intention is for there to be very limited access to the assets of the sponsor, borrower or developer in a scenario where the project loans are not repaid.

What are examples of project finance?

Project finance is agnostic as a discipline to geography, size and community. Examples of project financing that HCR Law’s Banking and Finance team have worked on include:

- Renewable energy projects, including solar, hydro-power, wind, and battery

- Oil and gas developments including LNG terminals and oil fields

- Power plants

- Metal and mining projects and

- Infrastructure projects.